The New Wellness Mandate: Key Insights Transforming the Supplement Industry

Let’s take a look at what our Beauty Buddies have to say on the subject.

The health and wellness sector is shifting from general nutrition to a results-oriented market. Today’s consumer is research-driven, looking for specific aesthetic and functional outcomes. Based on our latest survey data, here are the dominant trends driving the next wave of growth in the vitamins, minerals, and supplements (VMS) industry.

Beauty Buddy’s latest survey reveals fascinating insights into how consumers approach vitamins, minerals, and supplements, highlighting trends that are redefining the beauty and wellness market. From usage patterns to trust in information sources, these findings are essential for brands looking to connect with informed and health-conscious consumers.

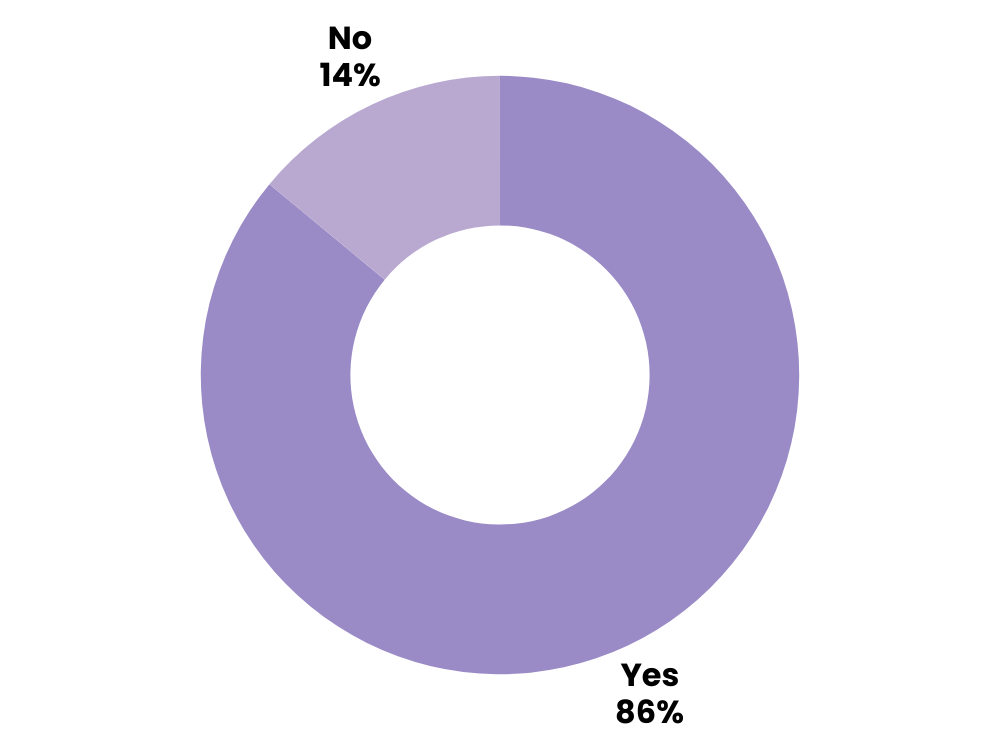

Most Consumers Have Made Supplements a Daily Habit

Our research shows that supplements are now a routine part of daily life for the majority of respondents. A striking 86% reported taking vitamins, minerals, or supplements regularly, leaving only a small 14% who do not. This high adoption rate signals that the wellness industry continues to be a critical touchpoint for consumers actively seeking solutions to support their health and beauty goals.

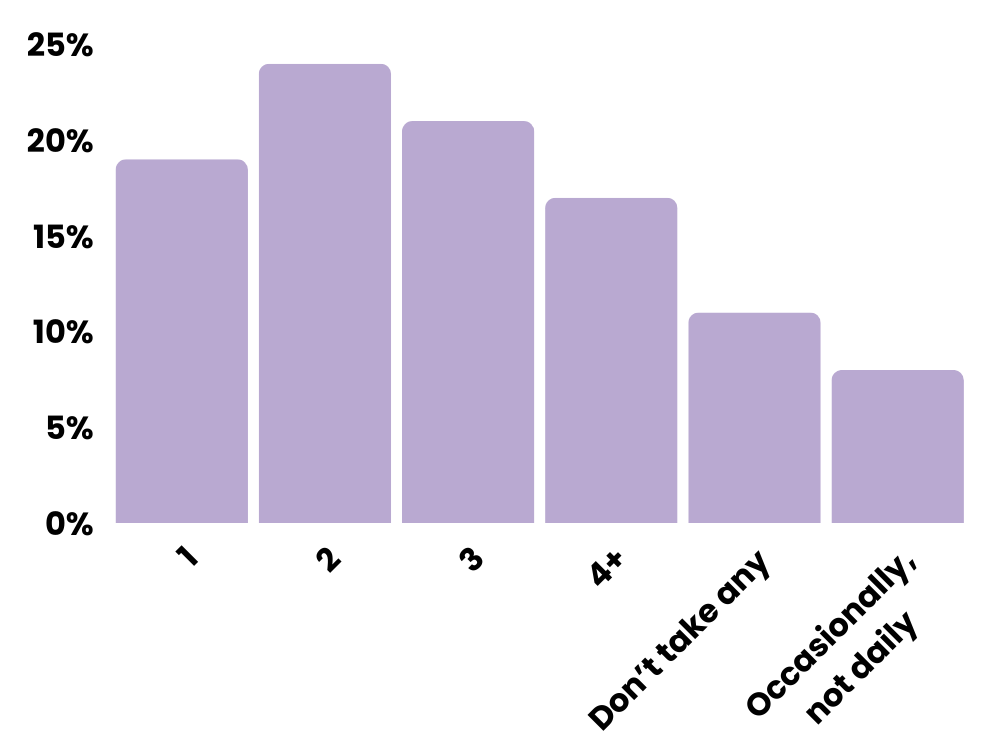

Daily Intake is Diverse, With Many Taking Multiple Supplements

When it comes to daily usage, most people don’t stop at just one supplement. 24% of respondents take two supplements daily, while 21% take three. Meanwhile, 19% stick to just one, and 17% take four or more. Interestingly, 8% take supplements occasionally rather than daily, showing that flexibility in routine can be a factor in purchasing and product formulation.

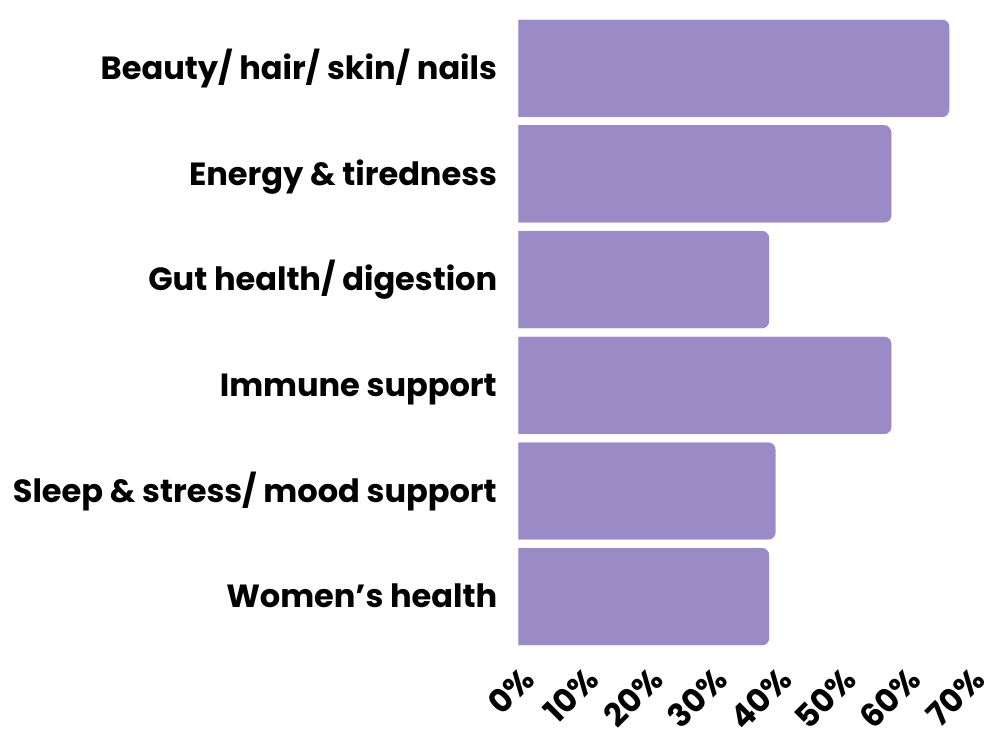

Beauty, Energy, and Wellness Drive Supplement Choices

Consumers are motivated by a range of health and beauty needs, and supplements are increasingly being seen as a way to address both. 67% of respondents take vitamins specifically for beauty benefits, including hair, skin, and nails. Other top motivations include boosting energy and combating tiredness (58%), supporting the immune system (58%), improving sleep and managing stress (40%), supporting gut health (39%), and women’s health concerns such as menstrual cycle, peri-menopause, or menopause (39%). This data underscores that supplements are no longer seen as purely functional but also as lifestyle enhancers.

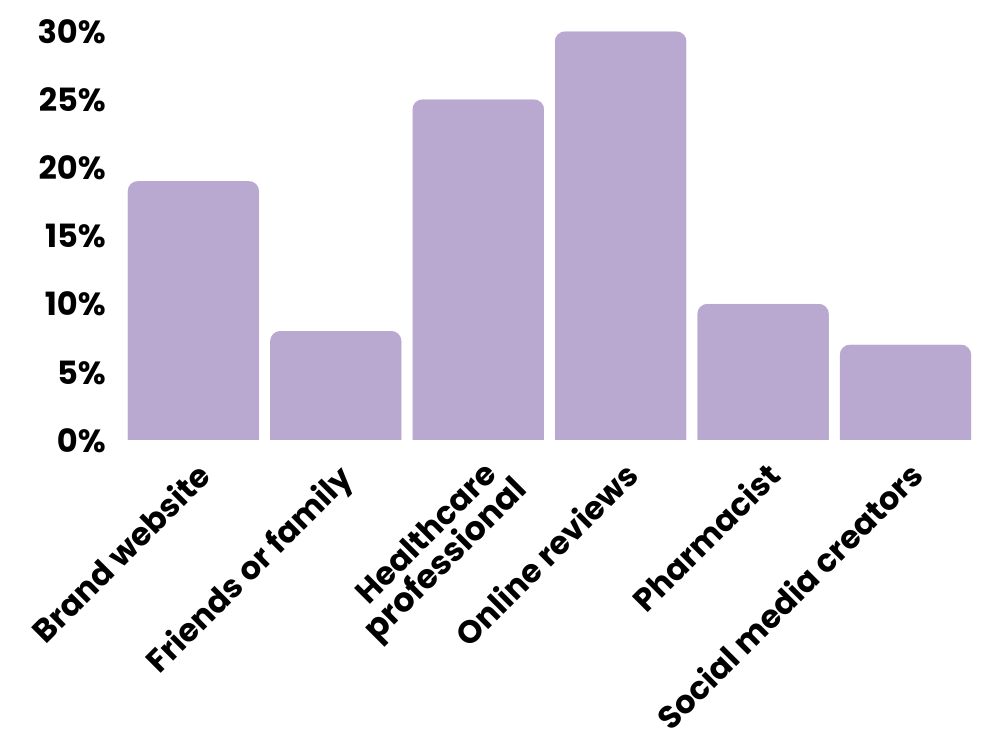

Trust in Decision-Making is Rooted in Evidence and Community Feedback

When deciding which products to purchase, consumers rely heavily on trusted sources. Online reviews and community feedback lead the way, influencing 30% of respondents’ choices. Healthcare professionals such as GPs are also highly trusted (25%), followed by brand websites and product information (19%) and pharmacists (10%). Friends, family, and social media influencers hold less sway, demonstrating that credibility, evidence, and peer validation are critical factors in purchasing decisions.

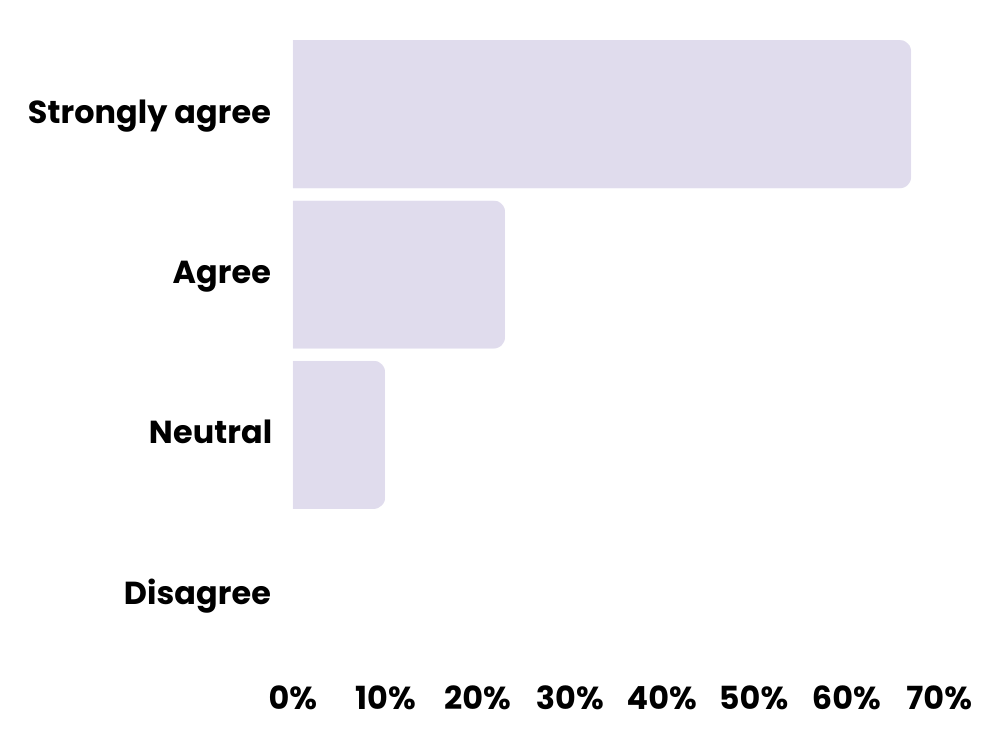

Evidence-Based Supplements Are Non-Negotiable

Our survey confirms that consumers strongly value clinically researched products. A notable 67% strongly agree that they prefer supplements that are evidence-based, with another 23% agreeing. Only 10% remained neutral, and no one disagreed. For brands, this clearly highlights the importance of scientific backing, transparent formulations, and credible claims when marketing wellness products.

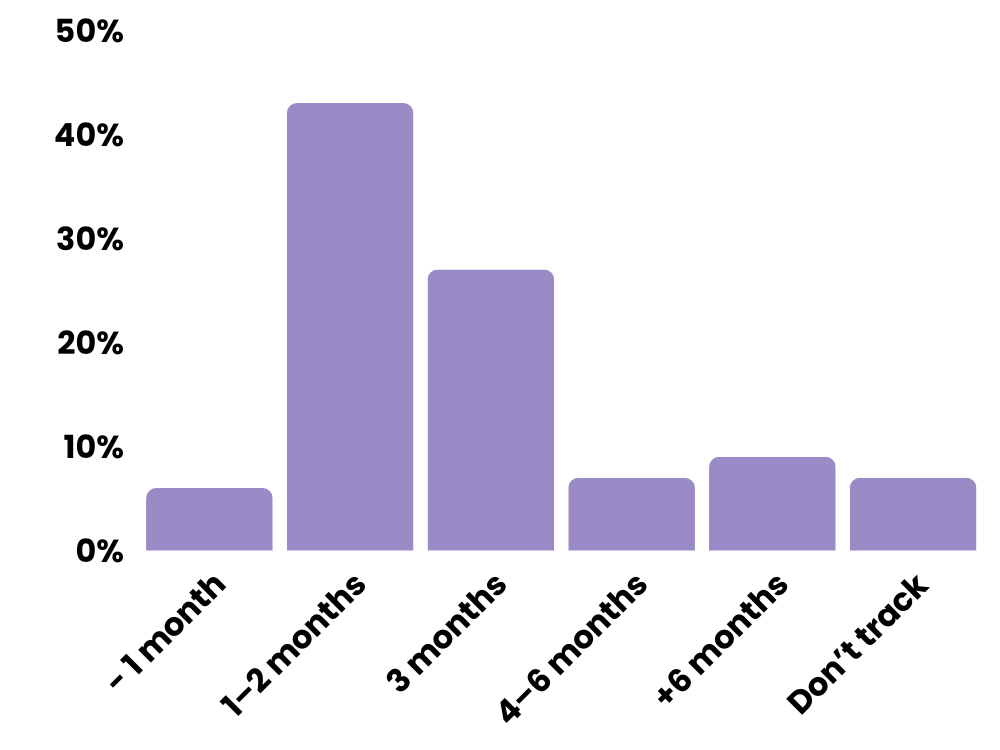

Consumers Expect to See Results Within a Few Months

Patience with supplements varies, but most consumers give products time to demonstrate results before deciding whether to continue. 43% evaluate effectiveness within 1–2 months, while 27% give supplements three months to work. Only 9% continue longer than six months without assessing efficacy. Brands that can clearly communicate expected timelines and measurable benefits are more likely to retain satisfied, long-term users.

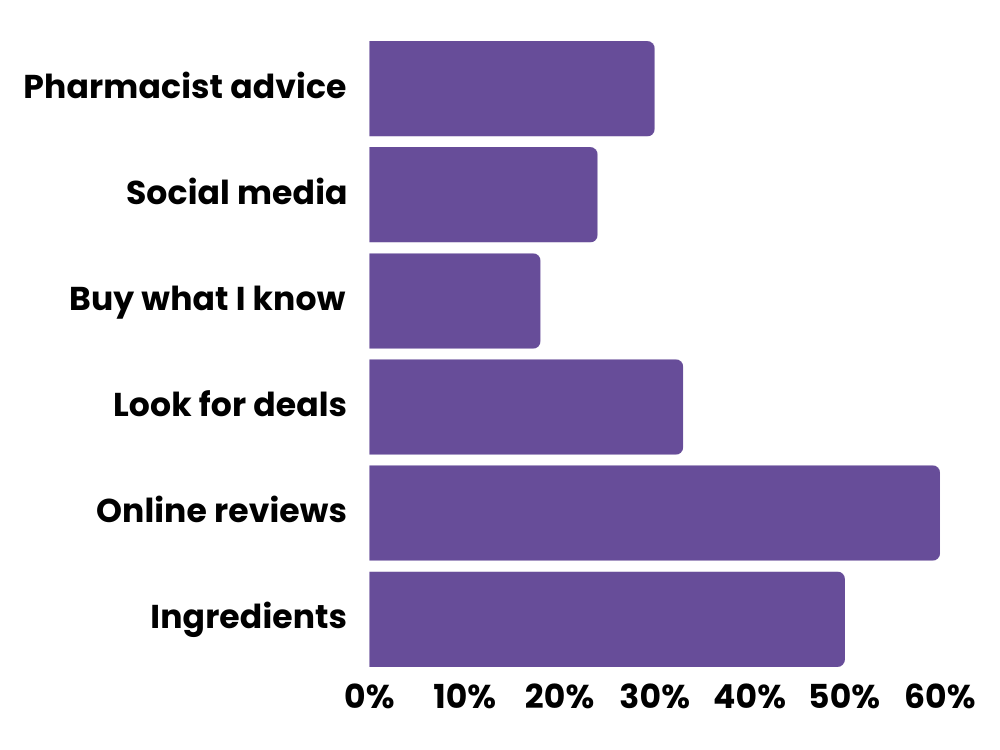

Smart Shoppers Do Their Homework Before Buying

Purchasing decisions are informed and intentional. 60% of respondents research online reviews, and 50% study product ingredients and formulations before buying. 33% look for promotions or compare prices, and 30% consult a pharmacist or healthcare professional. Social media recommendations influence 24%, while 18% purchase products they are already familiar with. For brands, this demonstrates the importance of clear, transparent information, strong online presence, and education-focused content to guide informed choices.

To find out more about how Beauty Buddy can help your brand with fresh, authentic content every month, reach out we would love the opportunity to find out more about your brand and your goals.

Are you keen to gather valuable feedback and insights directly from your target audience? Don't hesitate to reach out to us today to discuss the exciting possibilities of running targeted surveys. Let us help you achieve your goals!

We understand the importance of knowing your target audience. Do you make assumptions about your consumers, their preferences, opinions and needs? Understanding your consumers is key to ensuring your business decisions are well-informed and effective.

AT PXBB we run targeted survey campaigns, through Beauty Buddy the app, for our clients. Surveys provide answers, generate fresh data and insights, they substantiate assumptions and also help identify new trends.