Blush Trends 2025 vs 2026: Subtle Shifts, Clear Signals

Let’s take a look at what our Beauty Buddies have to say on the subject.

At Beauty Buddy, we asked our community the exact same blush questions in 2025 and 2026 to track real shifts in preferences — not guesses, not predictions, but data-backed movement.

The result? No dramatic disruption — but several meaningful shifts that reveal how blush is maturing as a category.

Below is a deeper look at what changed, what stabilised, and what it means for brands.

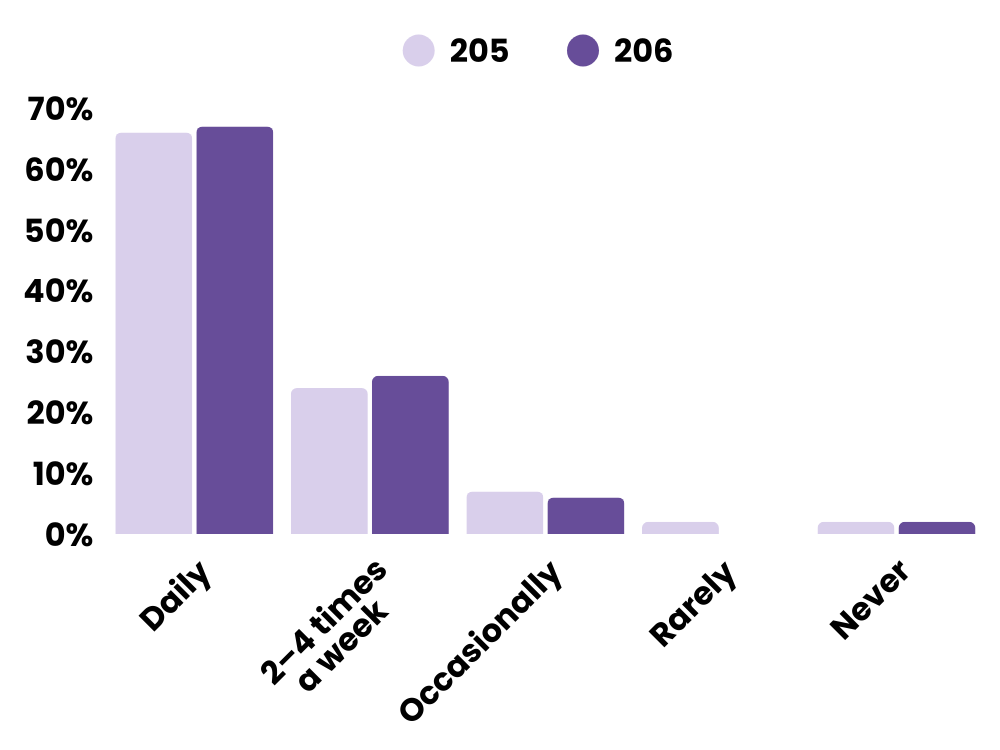

Frequency of Use

Daily: 66% → 67%

2–4 times a week: 24% → 26%

Rarely/Never combined: 4% → 2%

Blush remains a daily essential for the majority, with 67% using it every day in 2026.

This reinforces blush as a staple product — not trend-led or occasional, but routine-driven.

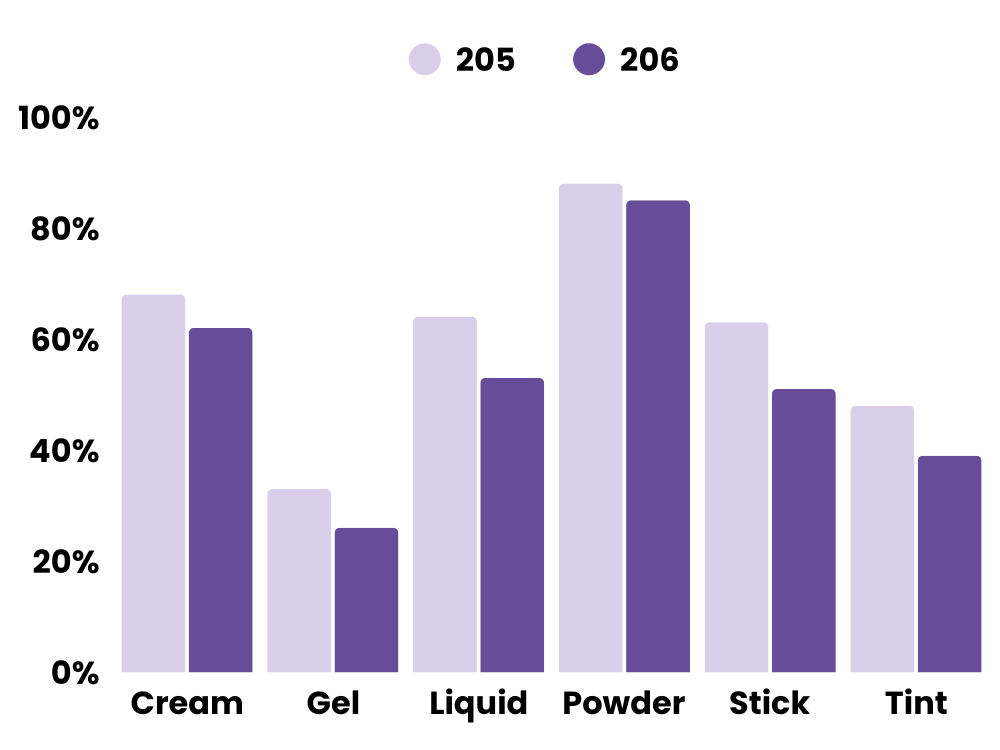

Texture Trends: The Cream Surge Slows

Preferred Textures

Cream: 68% → 62%

Gel: 33% → 26%

Liquid: 64% → 53%

Powder: 88% → 85%

Stick: 63% → 51%

Tint: 48% → 39%

The most significant declines:

Stick: -12%

Liquid: -11%

Tint: -9%

Gel: -7%

Powder remains dominant at 85%, with only a slight decrease.

After years of cream and liquid momentum across social platforms, 2026 data suggests a stabilisation phase. Consumers appear to be returning to reliable, familiar formats — particularly powder — possibly linked to longevity, control, and brush-based application trends.

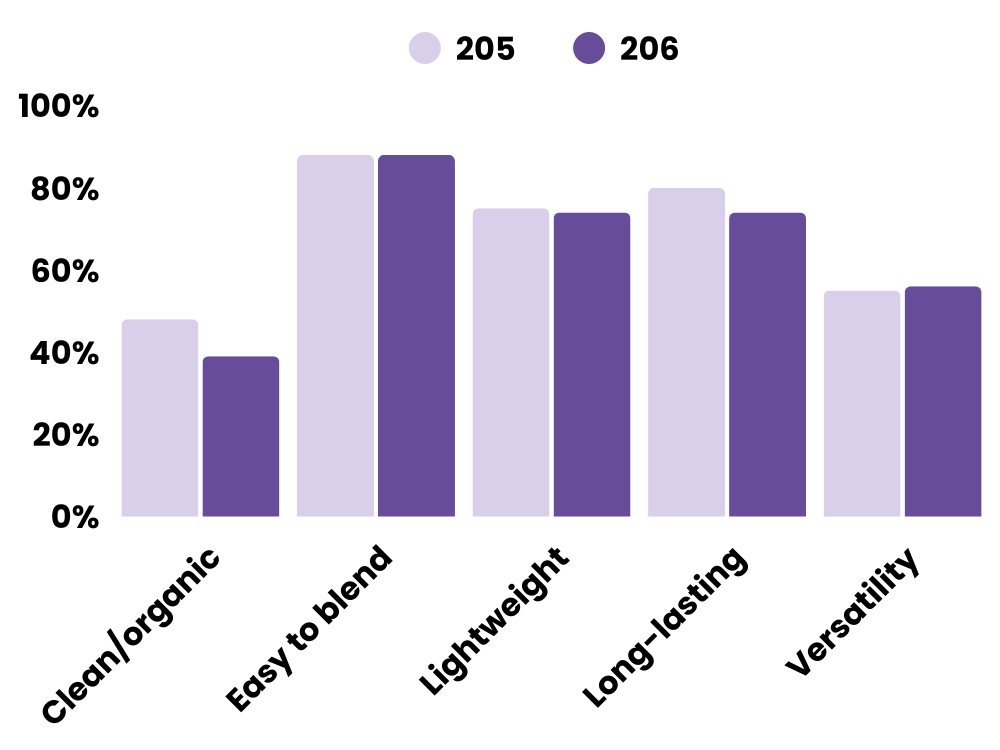

What Makes a Blush Stand Out?

Easy to blend: 88% → 88%

Long-lasting formula: 80% → 74%

Lightweight feel: 75% → 74%

Clean/organic ingredients: 48% → 39%

Versatility: 55% → 56%

The largest shift is the -9% drop in “clean/organic ingredients.”

While still important to many, it appears less of a differentiating driver compared to 2025. Performance factors — particularly blendability — remain dominant at 88%, unchanged year-on-year.

Notably, long-lasting claims dropped -6%, potentially reflecting greater consumer confidence in baseline product performance across the category.

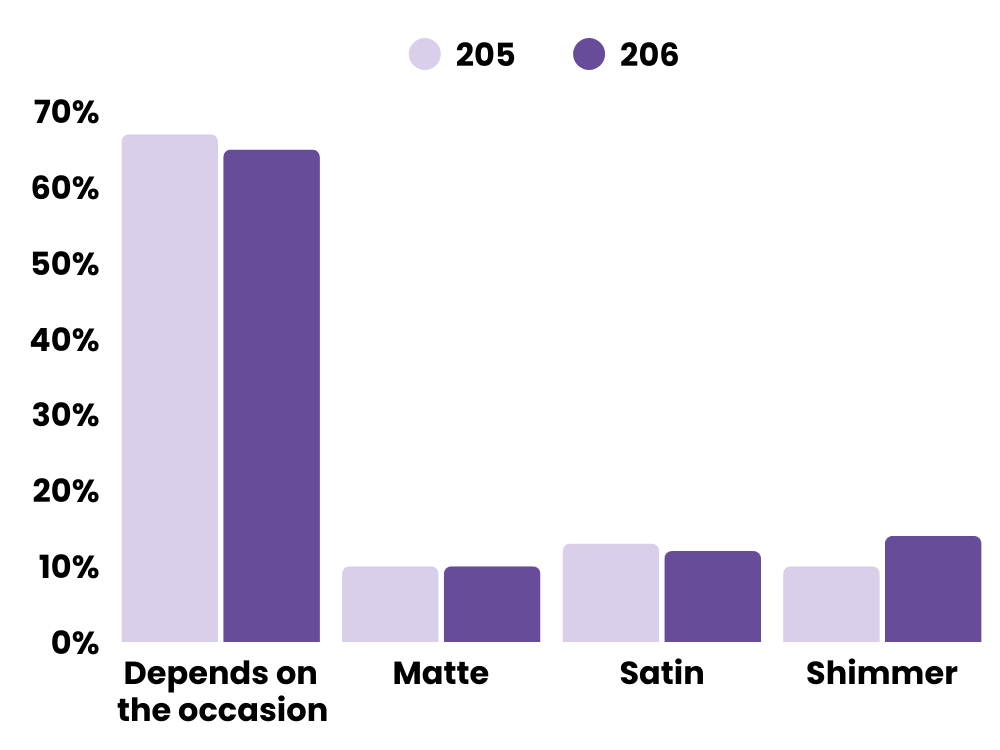

Finish & Pigmentation: Control Over Intensity

Finish Preferences

It depends on the occasion: 67% → 65%

Matte: 10% → 10%

Satin: 13% → 12%

Shimmer: 10% → 14%

The standout movement is shimmer at +4%, indicating a modest return to glow. While consumers still adapt finishes based on occasion, subtle luminosity is regaining traction.

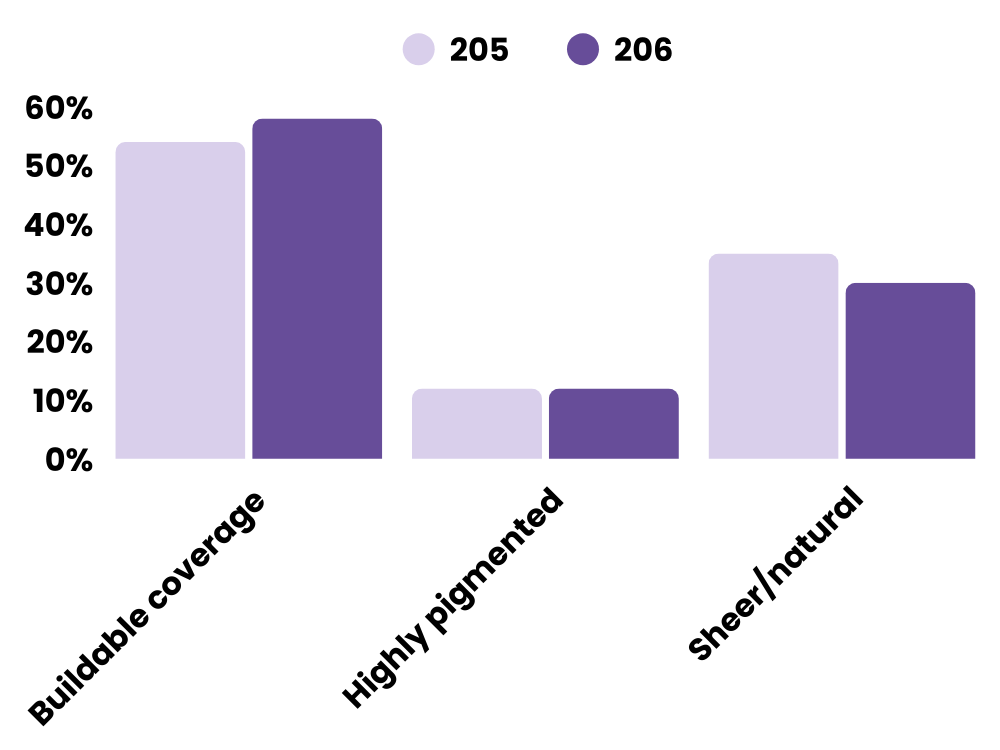

Pigmentation Priorities

Buildable coverage: 54% → 58%

Highly pigmented: 12% → 12%

Sheer/natural: 35% → 30%

Buildable coverage increased +4%, while sheer formulas declined -5%.

Consumers are signalling they want flexibility — not overpowering pigment, but not ultra-sheer either. The preference is shifting toward formulas that allow layering and control, aligning with a more personalised approach to makeup application.

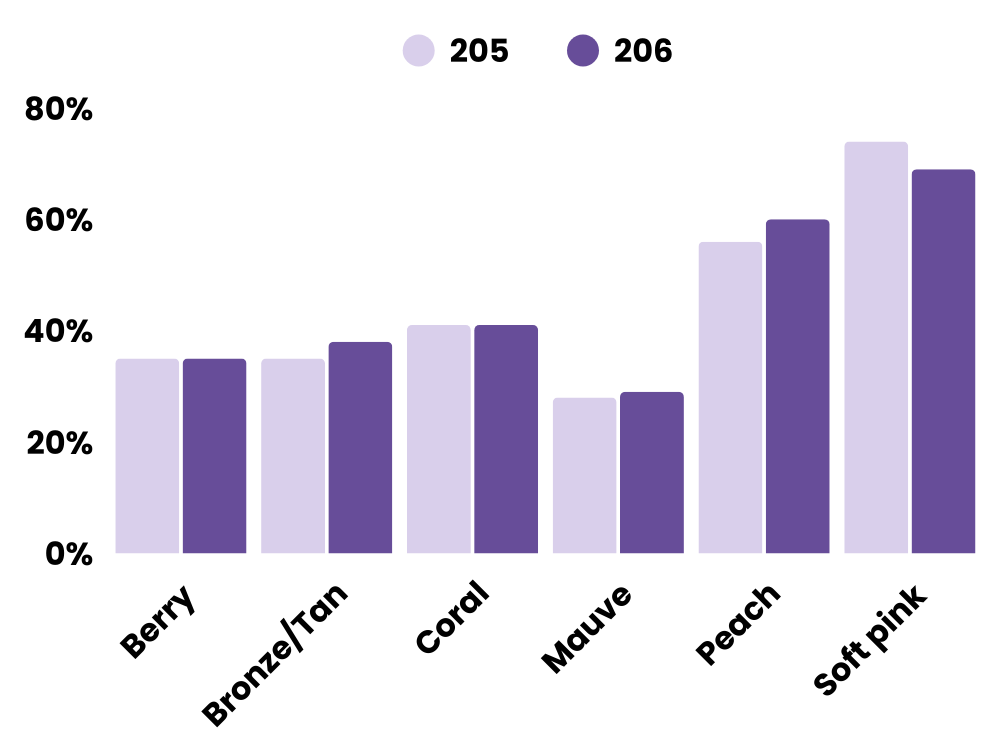

Shade Preferences: Peach Gains Ground

Soft pink: 74% → 69%

Peach: 56% → 60%

Bronze/Tan: 35% → 38%

Coral: 41% → 41%

Berry: 35% → 35%

Mauve: 28% → 29%

Soft pink remains dominant but declined -5%, while peach increased +4%.

The shift suggests a move toward warmer tones, possibly reflecting seasonal adaptability and broader skin-tone inclusivity trends.

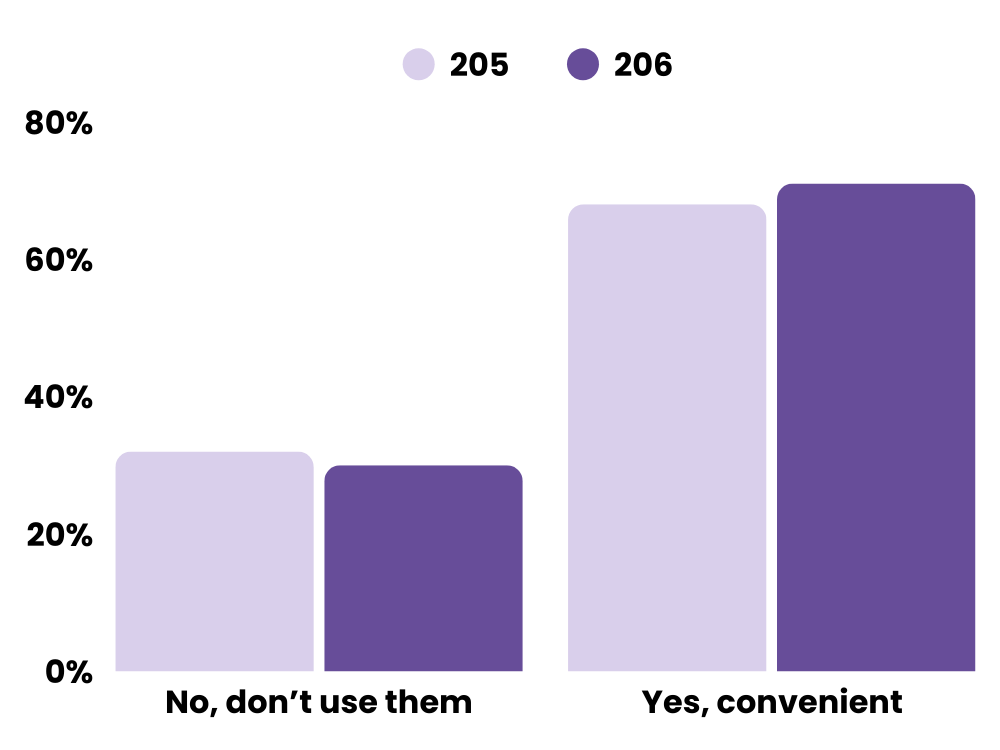

Packaging: Function Continues to Win

Mirrors & Applicators

Yes, convenient: 68% → 71%

No, don’t use them: 32% → 30%

Convenience increased by +3%, reinforcing that portability still matters. While this isn’t a dramatic jump, it confirms that practical add-ons remain valued in everyday makeup routines.

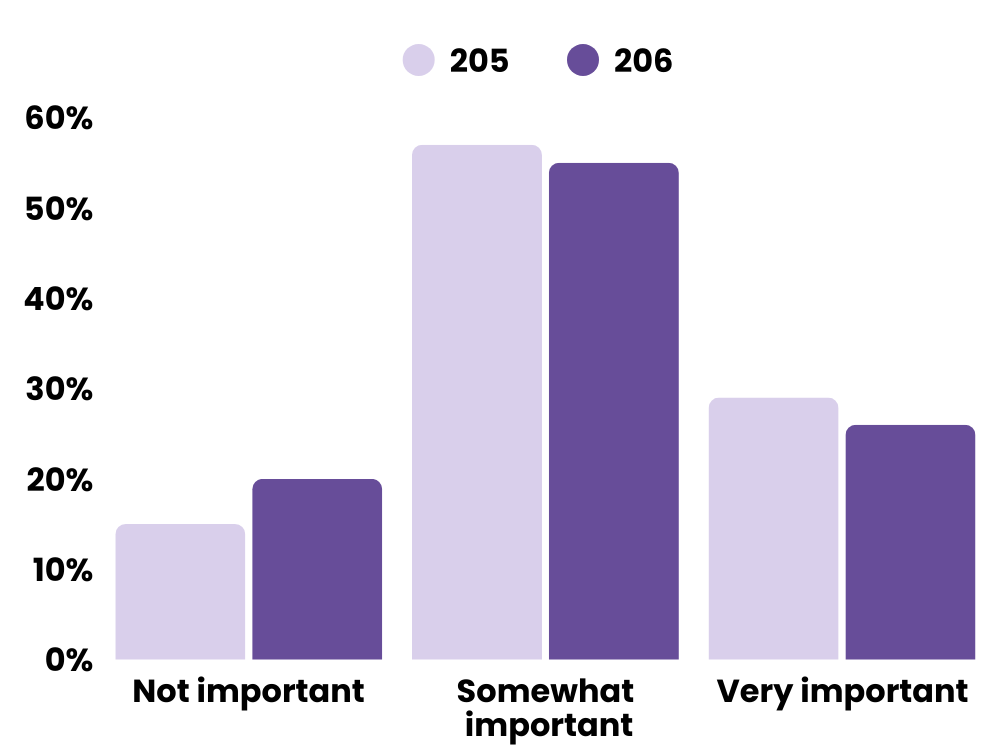

Packaging Importance

Not important: 15% → 20%

Somewhat important: 57% → 55%

Very important (aesthetic): 29% → 26%

The notable shift here is the +5% rise in consumers saying packaging is “not important.”

This suggests a continued move away from aesthetic-led purchasing. Consumers are prioritising formula performance over design appeal — a significant message for brands investing heavily in visual differentiation.

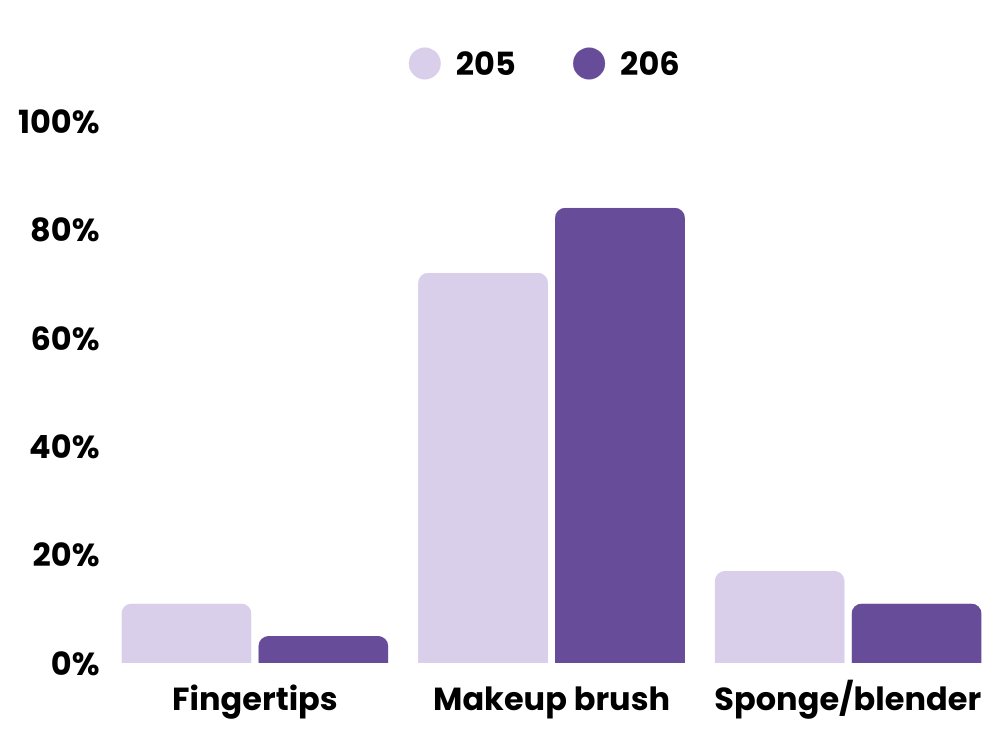

Application Tools: Precision is Trending

Makeup brush: 72% → 84%

Fingertips: 11% → 5%

Sponge/blender: 17% → 11%

The most dramatic shift in the entire dataset:

Makeup brush usage increased by +12%.

This aligns with:

The rise in buildable coverage

The stability of powder textures

A preference for controlled application

Consumers appear to be favouring precision over quick blending methods.

2026 Consumer Profile: What the Data Suggests

Compared to 2025, the 2026 blush consumer is:

Slightly more performance-focused

Less influenced by “clean” positioning

Returning to classic powder reliability

Using brushes significantly more

Prioritising buildable control

Experimenting, but with growing brand trust

The overall message isn’t dramatic disruption — it’s refinement.

Blush is no longer driven by hype cycles around texture. It’s settling into a performance-led, routine-driven category where control, blendability, and practical formats matter most.

For brands, that means:

Precision tools matter

Messaging should focus on usability and control

Texture innovation must offer real functional benefits

Packaging aesthetics alone won’t convert

The blush category isn’t cooling — it’s maturing.

To find out more about how Beauty Buddy can help your brand with fresh, authentic content every month, reach out we would love the opportunity to find out more about your brand and your goals.

Are you keen to gather valuable feedback and insights directly from your target audience? Don't hesitate to reach out to us today to discuss the exciting possibilities of running targeted surveys. Let us help you achieve your goals!

We understand the importance of knowing your target audience. Do you make assumptions about your consumers, their preferences, opinions and needs? Understanding your consumers is key to ensuring your business decisions are well-informed and effective.

AT PXBB we run targeted survey campaigns, through Beauty Buddy the app, for our clients. Surveys provide answers, generate fresh data and insights, they substantiate assumptions and also help identify new trends.